M&A Analyst

Capital Markets & Advisory | Corporate Finance M&A | Analyst |New York

About ING:

In Americas, ING’s Wholesale Banking division offers a broad range of innovative financial products and services to domestic and international corporate and institutional clients.

When you come to work at ING, you’re joining a team where individuality isn’t just accepted, it’s encouraged. We’ve built a culture that’s fun, friendly and supportive – it’s the kind of place where you can be yourself and make the most of whatever you have to offer.

We give people the freedom to take risks, think differently, take ownership of their work, and make great things happen. We’re here to help you get ahead. And with our global network, there’s plenty of scope to take your career in new directions, perhaps even ones you’ve never considered. ING Americas follows a hybrid work model, allowing for in-office / work from home flexibility. Hybrid work arrangements vary based on business area.

Sound like the kind of place you’d feel at home? We’d love to hear from you.

About the position:

We are looking for an experienced Analyst with 2-3 years of M&A experience at a reputable investment bank or boutique. The Corporate Finance M&A role offers a mix of hands-on transaction experience across industries and deal size ranges, with the majority having a cross-border aspect. You will work with other team members globally in the analysis, financial modeling, negotiation, sourcing, and managing of M&A and advisory transactions on behalf on ING’s clients, both financial sponsors and corporates.

Title: Analyst

Department: Corporate Finance M&A, part of Capital Markets & Advisory

Line Manager: Head of Corporate Finance, Americas

Location: New York

About the department:

ING Corporate Finance advises on M&A transactions, including buy side and sell side deals, strategic advisory assignments and capital raisings. The team supports the ING client base across many sectors, with a focus on transportation and infrastructure, food and agriculture, energy, telecom, media and technology (TMT). Corporate Finance is a growing M&A platform in New York that is part of a dynamic global team that also operates out of ING’s offices in London, Amsterdam, Madrid, Brussels, Frankfurt, Manila, Hong Kong and Singapore.

The Corporate Finance team is part of Capital Markets & Advisory (CMA) group. The Capital Markets & Advisory group has a dedicated Early Career Program that provides junior talent the opportunity to learn more about core and client facing areas of ING’s Capital Markets and Advisory business area. The aim of this program is to upskill talent and prepare you for future roles in our organization. During the program, you will get hands-on experience of what is involved in the day-to-day role as a junior team member in the Corporate Finance, Debt Capital Markets, Loan Distributions and Acquisition Finance teams.

Responsibilities :

- Working within the Corporate Finance M&A team in New York with a focus on originating and executing M&A deals, strategic advisory assignments and capital raising transactions

- You assist in the origination of new business opportunities by preparing and delivering client presentations, conducting sector and company research and tracking, as well as preparing briefing packages for both internal and external use

- You support the execution efforts on transactions and assist the team in ensuring timely and successful closings, working directly with senior team members

- You are responsible for sourcing, synthesizing and presenting complex information and preparing thorough financial and valuation analyses

- You actively participate in client meetings and build your business insight and interpersonal skills

- You contribute to revenue targets and assist in meeting the global budget

- You respond to information requests from the Global Corporate Finance platform related to companies and businesses located in North America

- You liaise closely with colleagues in other CM&A departments to deliver integrated solutions to ING’s clients

- You maintain close ties with the relevant product and sector teams within ING, including Sector Coverage, Acquisition Finance, Corporate Investments, Loan Capital Markets, Debt Capital Markets, Equity Capital Markets and Sustainable Finance teams

Qualifications and Competencies

Senior Analysts have 2 to 3 years of working experience within M&A at a reputable investment bank or boutique. Suitable candidates have demonstrable hands-on experience in M&A on a daily basis, have a high energy level, strong commercial drive, attention to detail, ability to work time-efficiently within a team setting and are able to represent the team well, both internally and externally.

- You have a strong interest in and solid understanding of M&A and advisory processes

- As an Analyst, you should have hands-on experience in valuation and financial modeling, and demonstrate the ability to distill complex data into clear, well-structured presentations

- You show perseverance, creativity and high attention to detail

- You are willing to go above and beyond for the sake of the team and client’s objectives

- You work efficiently as part of a team as well as individually

- You possess strong communication skills

- You have the ambition to mentor and train more junior team members

- You have, or are expected to obtain in short order, Series 7 or 79, and 63 registrations

Salary Range $105,000-$115,000

In addition to comprehensive health benefits, a generous 401k savings plan, and competitive PTO, ING provides a broad array of benefits including adoption, surrogacy, and fertility services; student debt assistance; and subsidies for expenses associated with commuting and fitness.

ING is a committed equal opportunity employer. We welcome applicants of diverse backgrounds and hire without regard to color, gender, religion, national origin, citizenship, disability, age, sexual orientation, or any other characteristic protected by law. We celebrate these differences and rely upon your unique perspective to innovate and seize new opportunities. Come as you are.

ING Bank does not have a commercial banking license in the U.S. and therefore not permitted to conduct a commercial banking business in the U.S. Through its wholly owned subsidiary ING Financial Services LLC, and its affiliates, it offers a full array of wholesale products such as commercial lending and a full range of FM products and services

Your place of work

Explore the area

Your place of work

Explore the area

Questions? Just ask

ING Recruitment team

W ING chcemy, aby każdy mógł w pełni wykorzystać swój potencjał. Tworzymy inkluzywną kulturę, w której każdy ma szansę na rozwój i wpływ na naszych klientów oraz społeczeństwo. Zawsze wspieramy różnorodność, równość i integrację. Nie tolerujemy żadnej formy dyskryminacji, czy to z powodu wieku, płci, tożsamości płciowej, kultury, doświadczenia, religii, rasy, niepełnosprawności, obowiązków rodzinnych, orientacji seksualnej lub czegokolwiek innego. Jeśli potrzebujesz wsparcia lub dostosowania podczas procesu rekrutacji lub rozmowy, skontaktuj się z rekruterem wskazanym w ogłoszeniu. Z przyjemnością pomożemy Ci, aby proces był sprawiedliwy i dostępny. Dowiedz się więcej o naszym zaangażowaniu na rzecz różnorodności i integracji tutaj.

Więcej informacji

-

Events Come see us in person! May 02, 2024 Events

Events Come see us in person! May 02, 2024 Events -

Bankowość detaliczna Dołącz do ING w Bankowości Detalicznej, aby wspierać klientów w podejmowaniu mądrych decyzji finansowych w cyfrowym świecie. May 15, 2024 Article Expertise & Teams Related Content Retail Banking

Bankowość detaliczna Dołącz do ING w Bankowości Detalicznej, aby wspierać klientów w podejmowaniu mądrych decyzji finansowych w cyfrowym świecie. May 15, 2024 Article Expertise & Teams Related Content Retail Banking -

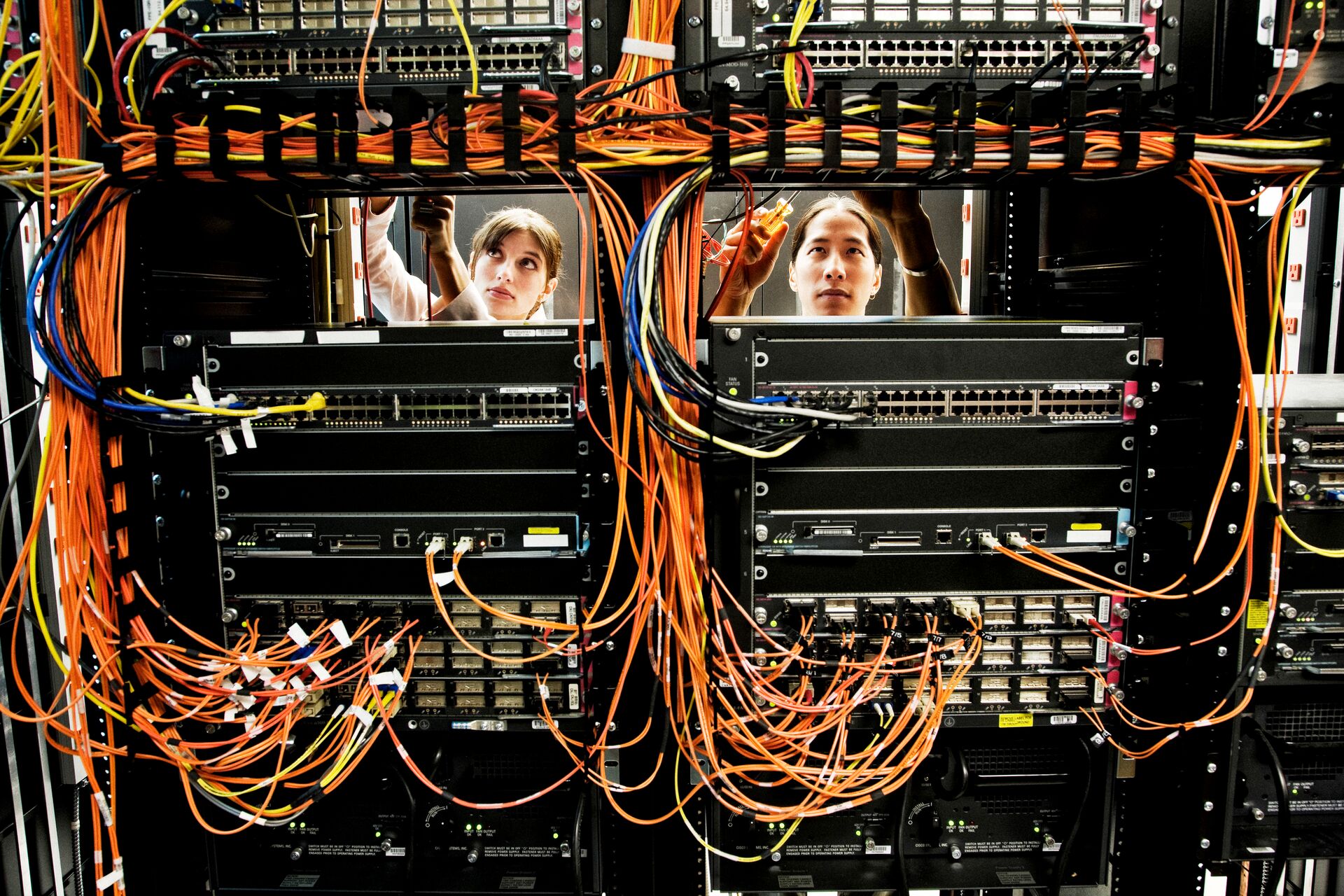

Pion Tech Wprowadzaj innowacje i zarządzaj naszą infrastrukturą technologiczną, aby wspierać rozwój biznesu. Bądź technologicznym guru napędzającym naszą cyfrową ewolucję. May 15, 2024 Article Expertise & Teams

Pion Tech Wprowadzaj innowacje i zarządzaj naszą infrastrukturą technologiczną, aby wspierać rozwój biznesu. Bądź technologicznym guru napędzającym naszą cyfrową ewolucję. May 15, 2024 Article Expertise & Teams -

Pion Ryzyka Identyfikuj, oceniaj i ograniczaj ryzyko, aby chronić nasze zasoby. Zapewniaj naszej organizacji funkcjonowanie zgodne z naszym apetytem na ryzyko. May 15, 2024 Article Overview Expertise & Teams

Pion Ryzyka Identyfikuj, oceniaj i ograniczaj ryzyko, aby chronić nasze zasoby. Zapewniaj naszej organizacji funkcjonowanie zgodne z naszym apetytem na ryzyko. May 15, 2024 Article Overview Expertise & Teams -

ING Hubs Dołącz do ING Hubs i kształtuj transformację cyfrową w bankowości. Odkryj różnorodne możliwości w naszej globalnej sieci! May 15, 2024 Overview ING Hubs

ING Hubs Dołącz do ING Hubs i kształtuj transformację cyfrową w bankowości. Odkryj różnorodne możliwości w naszej globalnej sieci! May 15, 2024 Overview ING Hubs -

Informacje o ING Dołącz do ING, globalnego banku wspierającego ludzi i firmy. Ciesz się zróżnicowaną, inkluzywną kulturą z elastycznymi możliwościami pracy i rozwoju. June 28, 2024 Article Culture

Informacje o ING Dołącz do ING, globalnego banku wspierającego ludzi i firmy. Ciesz się zróżnicowaną, inkluzywną kulturą z elastycznymi możliwościami pracy i rozwoju. June 28, 2024 Article Culture -

Wholesale Banking Uczestnicz w zapewnieniu naszym klientom i klientkom najlepszych usług finansowych. August 12, 2024 Article Expertise & Teams Related Content Wholesale Banking

Wholesale Banking Uczestnicz w zapewnieniu naszym klientom i klientkom najlepszych usług finansowych. August 12, 2024 Article Expertise & Teams Related Content Wholesale Banking -

Audyt Dbamy o uczciwość i przejrzystość naszych operacji finansowych, zapewniając zgodność z przepisami i identyfikując obszary wymagające poprawy. Bądź na straży i chroń zdrowie naszej organizacji. August 12, 2024 Article Expertise & Teams

Audyt Dbamy o uczciwość i przejrzystość naszych operacji finansowych, zapewniając zgodność z przepisami i identyfikując obszary wymagające poprawy. Bądź na straży i chroń zdrowie naszej organizacji. August 12, 2024 Article Expertise & Teams -

Wsparcie biznesowe i zarządzanie biznesem Pomóż w zapewnieniu naszym zespołom płynnego wsparcia operacyjnego i zarządzania strategicznego. Bądź jednym z filarów sprawnego i wydajnego funkcjonowania naszej firmy. August 12, 2024 Article Expertise & Teams

Wsparcie biznesowe i zarządzanie biznesem Pomóż w zapewnieniu naszym zespołom płynnego wsparcia operacyjnego i zarządzania strategicznego. Bądź jednym z filarów sprawnego i wydajnego funkcjonowania naszej firmy. August 12, 2024 Article Expertise & Teams -

Pion klienta detalicznego i biznesowego Zwiększ satysfakcję klientów i klientek usprawniając procesy biznesowe. Bądź zaufanym partnerem, zapewniającym wysoką jakość każdej interakcji. August 12, 2024 Article Expertise & Teams Related Content

Pion klienta detalicznego i biznesowego Zwiększ satysfakcję klientów i klientek usprawniając procesy biznesowe. Bądź zaufanym partnerem, zapewniającym wysoką jakość każdej interakcji. August 12, 2024 Article Expertise & Teams Related Content -

Komunikacja i marketing Kształtuj naszą narrację i twórz niezapomniane doświadczenia związane z marką. Bądź głosem, który urzeka i obrazem, który zapada w pamięć. August 12, 2024 Article Expertise & Teams

Komunikacja i marketing Kształtuj naszą narrację i twórz niezapomniane doświadczenia związane z marką. Bądź głosem, który urzeka i obrazem, który zapada w pamięć. August 12, 2024 Article Expertise & Teams -

Compliance Pomóż w dbaniu o przestrzeganie przepisów i utrzymywaniu najwyższych standardów etycznych. Stań na straży spełniania wymogów regulacyjnych. August 12, 2024 Article Expertise & Teams Related Content

Compliance Pomóż w dbaniu o przestrzeganie przepisów i utrzymywaniu najwyższych standardów etycznych. Stań na straży spełniania wymogów regulacyjnych. August 12, 2024 Article Expertise & Teams Related Content -

Zarządzanie bezpieczeństwem obiektów Zarządzaj naszymi środowiskami fizycznymi i organizacyjnymi, aby zoptymalizować wydajność. Bądź twórcą przestrzeni, w których powstają innowacje. August 12, 2024 Article Expertise & Teams Related Content

Zarządzanie bezpieczeństwem obiektów Zarządzaj naszymi środowiskami fizycznymi i organizacyjnymi, aby zoptymalizować wydajność. Bądź twórcą przestrzeni, w których powstają innowacje. August 12, 2024 Article Expertise & Teams Related Content -

Customer Experience Ulepszaj interakcje z odbiorcami naszych usług, aby tworzyć wyjątkowe ścieżki klienta/klientki. Buduj z nami satysfakcję i lojalność klientów. August 12, 2024 Article Expertise & Teams Related Content

Customer Experience Ulepszaj interakcje z odbiorcami naszych usług, aby tworzyć wyjątkowe ścieżki klienta/klientki. Buduj z nami satysfakcję i lojalność klientów. August 12, 2024 Article Expertise & Teams Related Content -

Modelowanie i analiza danych Wykorzystaj dane, aby wyciągnąć wnioski i pomóc w podejmowaniu decyzji. Bądź potęgą analityczną napędzającą nasze strategiczne działania. August 12, 2024 Article Expertise & Teams Related Content

Modelowanie i analiza danych Wykorzystaj dane, aby wyciągnąć wnioski i pomóc w podejmowaniu decyzji. Bądź potęgą analityczną napędzającą nasze strategiczne działania. August 12, 2024 Article Expertise & Teams Related Content -

Finanse Pomóż w zarządzaniu naszą kondycją finansową i kieruj naszymi strategiami gospodarczymi. Bądź ekspertem finansowym / ekspertką finansową, który / która zapewni nam powodzenie. August 12, 2024 Article Expertise & Teams Related Content

Finanse Pomóż w zarządzaniu naszą kondycją finansową i kieruj naszymi strategiami gospodarczymi. Bądź ekspertem finansowym / ekspertką finansową, który / która zapewni nam powodzenie. August 12, 2024 Article Expertise & Teams Related Content -

Human Resources Pomagaj naszym pracownikom i pracowniczkom w rozwijaniu kompetencji i wspieraj angażującą kulturę pracy. Bądź mistrzem / mistrzynią rozwijania potencjału. August 12, 2024 Article Expertise & Teams Related Content

Human Resources Pomagaj naszym pracownikom i pracowniczkom w rozwijaniu kompetencji i wspieraj angażującą kulturę pracy. Bądź mistrzem / mistrzynią rozwijania potencjału. August 12, 2024 Article Expertise & Teams Related Content -

Departament Skarbu Nadzoruj nasze zarządzanie płynnością i kapitałem, aby zapewnić stabilność finansową. Bądź osobą odpowiedzialną za strategię zarządzającą naszymi zasobami finansowymi. August 12, 2024 Article Expertise & Teams Related Content

Departament Skarbu Nadzoruj nasze zarządzanie płynnością i kapitałem, aby zapewnić stabilność finansową. Bądź osobą odpowiedzialną za strategię zarządzającą naszymi zasobami finansowymi. August 12, 2024 Article Expertise & Teams Related Content -

Innowacje Twórz przyszłościowe rozwiązania i przełomowe inicjatywy. Wyznaczaj nowe ścieżki i prowadź naszą organizację w przyszłość. August 12, 2024 Article Expertise & Teams Related Content

Innowacje Twórz przyszłościowe rozwiązania i przełomowe inicjatywy. Wyznaczaj nowe ścieżki i prowadź naszą organizację w przyszłość. August 12, 2024 Article Expertise & Teams Related Content -

Know Your Customer Upewnij się, że rozumiemy i spełniamy potrzeby naszych klientów i klientek, przestrzegając przepisów. Spraw, abyśmy znali naszych klientów możliwie jak najlepiej. August 12, 2024 Article Expertise & Teams Related Content

Know Your Customer Upewnij się, że rozumiemy i spełniamy potrzeby naszych klientów i klientek, przestrzegając przepisów. Spraw, abyśmy znali naszych klientów możliwie jak najlepiej. August 12, 2024 Article Expertise & Teams Related Content -

Departament Prawny Udzielaj specjalistycznych porad prawnych i monitoruj zmiany w prawie powszechnie obowiązującym. Pomóż zapewnić rozwój naszej firmy zgodny z przepisami. August 12, 2024 Article Expertise & Teams Related Content

Departament Prawny Udzielaj specjalistycznych porad prawnych i monitoruj zmiany w prawie powszechnie obowiązującym. Pomóż zapewnić rozwój naszej firmy zgodny z przepisami. August 12, 2024 Article Expertise & Teams Related Content -

Leadership Inspiruj zespoły i kieruj realizacją naszej wizji przyszłości. Wnieś naszą organizację na nowy poziom August 12, 2024 Article Expertise & Teams Related Content

Leadership Inspiruj zespoły i kieruj realizacją naszej wizji przyszłości. Wnieś naszą organizację na nowy poziom August 12, 2024 Article Expertise & Teams Related Content -

Zakupy Optymalizuj nasze procesy zakupowe i zabezpiecz zasoby wysokiej jakości. Negocjuj to, co najlepsze dla naszej firmy. August 12, 2024 Article Expertise & Teams Related Content

Zakupy Optymalizuj nasze procesy zakupowe i zabezpiecz zasoby wysokiej jakości. Negocjuj to, co najlepsze dla naszej firmy. August 12, 2024 Article Expertise & Teams Related Content -

Bankowość biznesowa Buduj i pielęgnuj trwałe relacje z naszymi partnerami biznesowymi. Buduj zaufanie i współpracę. August 12, 2024 Article Expertise & Teams Related Content

Bankowość biznesowa Buduj i pielęgnuj trwałe relacje z naszymi partnerami biznesowymi. Buduj zaufanie i współpracę. August 12, 2024 Article Expertise & Teams Related Content -

Transformacja Zarządzaj zmianami, które wspierają realizację naszych celów strategicznych. August 12, 2024 Article Expertise & Teams Related Content

Transformacja Zarządzaj zmianami, które wspierają realizację naszych celów strategicznych. August 12, 2024 Article Expertise & Teams Related Content -

International Talent Programme Rozpocznij swoją karierę w ING w ramach Międzynarodowego Programu Talentów: globalne rotacje, rozwój osobisty i różne obszary bankowości. August 13, 2024 Overview Early Careers: Global Graduate Programme Programmes

International Talent Programme Rozpocznij swoją karierę w ING w ramach Międzynarodowego Programu Talentów: globalne rotacje, rozwój osobisty i różne obszary bankowości. August 13, 2024 Overview Early Careers: Global Graduate Programme Programmes -

Wholesale Banking Dołącz do zespołu Wholesale Banking w ING, wspierając klientów korporacyjnych w strategii i efektywnych rozwiązaniach bankowych na całym świecie. August 13, 2024 Overview Expertise & Teams Related Content Wholesale Banking

Wholesale Banking Dołącz do zespołu Wholesale Banking w ING, wspierając klientów korporacyjnych w strategii i efektywnych rozwiązaniach bankowych na całym świecie. August 13, 2024 Overview Expertise & Teams Related Content Wholesale Banking -

Lokalizacje Odkryj lokalizacje ING w ponad 40 krajach! Znajdź możliwości kariery w regionach Ameryk, EMEA i APAC. August 13, 2024 Overview Expertise & Teams Related Content

Lokalizacje Odkryj lokalizacje ING w ponad 40 krajach! Znajdź możliwości kariery w regionach Ameryk, EMEA i APAC. August 13, 2024 Overview Expertise & Teams Related Content -

Expertise & Teams W ING nasze zróżnicowane zespoły wyróżniają się we wszystkich sektorach bankowości. Od bankowości detalicznej po bankowość hurtową, zarządzanie ryzykiem i technologię, zapewniamy dostosowane rozwiązania i innowacyjne strategie. August 13, 2024 Overview Expertise & Teams Related Content

Expertise & Teams W ING nasze zróżnicowane zespoły wyróżniają się we wszystkich sektorach bankowości. Od bankowości detalicznej po bankowość hurtową, zarządzanie ryzykiem i technologię, zapewniamy dostosowane rozwiązania i innowacyjne strategie. August 13, 2024 Overview Expertise & Teams Related Content -

Working at ING Working at ING means working with great people: friendly, collaborative and (we think) fun! We empower the people around us and our customers to stay a step ahead. A job at ING comes with autonomy and the expectation to drive progress, deliver a superior customer experience and create a more sustainable future for people and planet. August 13, 2024 Article Culture

Working at ING Working at ING means working with great people: friendly, collaborative and (we think) fun! We empower the people around us and our customers to stay a step ahead. A job at ING comes with autonomy and the expectation to drive progress, deliver a superior customer experience and create a more sustainable future for people and planet. August 13, 2024 Article Culture -

Early Careers Odkryj Early Careers w ING z programami dla trainee, stażami i kursami IT, które mają na celu rozbudzenie pasji i rozwój. August 13, 2024 Overview Students & Graduates Related Content

Early Careers Odkryj Early Careers w ING z programami dla trainee, stażami i kursami IT, które mają na celu rozbudzenie pasji i rozwój. August 13, 2024 Overview Students & Graduates Related Content -

Working at ING in the Netherlands August 13, 2024 Article Overview Related Content Location Spotlight

Working at ING in the Netherlands August 13, 2024 Article Overview Related Content Location Spotlight -

Working at ING in Australia Over 20 years ago, we launched the country’s first high-interest, fee-free online savings account. Today, we continue to lead with innovative products like home loans, superannuation, credit cards, and more. August 13, 2024 Article Overview Related Content Location Spotlight

Working at ING in Australia Over 20 years ago, we launched the country’s first high-interest, fee-free online savings account. Today, we continue to lead with innovative products like home loans, superannuation, credit cards, and more. August 13, 2024 Article Overview Related Content Location Spotlight -

Working at ING in Belgium With over 6,000 employees in Belgium, we’re a significant employer. Research shows that our vibrant ‘orange’ culture sets us apart. We offer impactful roles in an inclusive and collaborative work environment, competitive benefits, great flexibility thanks to our hybrid work model and opportunities to grow your career. August 13, 2024 Article Overview Related Content Location Spotlight Employee Stories

Working at ING in Belgium With over 6,000 employees in Belgium, we’re a significant employer. Research shows that our vibrant ‘orange’ culture sets us apart. We offer impactful roles in an inclusive and collaborative work environment, competitive benefits, great flexibility thanks to our hybrid work model and opportunities to grow your career. August 13, 2024 Article Overview Related Content Location Spotlight Employee Stories -

Working at ING in Germany We’ve got over 9 million customers in Germany who trust us, making us the third largest bank in the country. Our core business includes savings accounts, mortgages, investment products, consumer loans and current accounts for private customers. August 13, 2024 Article Overview Culture Expertise & Teams Students & Graduates Benefits ING Hubs Early Careers: Global Graduate Programme Early Careers: Local Opportunities Location Spotlight Employee Stories

Working at ING in Germany We’ve got over 9 million customers in Germany who trust us, making us the third largest bank in the country. Our core business includes savings accounts, mortgages, investment products, consumer loans and current accounts for private customers. August 13, 2024 Article Overview Culture Expertise & Teams Students & Graduates Benefits ING Hubs Early Careers: Global Graduate Programme Early Careers: Local Opportunities Location Spotlight Employee Stories -

Working at ING in Italy As a trusted partner for millions of corporate and retail clients, ING is active in Italy with its two business lines: Wholesale & Retail Banking. Our almost 1,300 employees are spread across our office in Milan and our branches and stores in 16 cities. August 13, 2024 Article Overview Related Content Location Spotlight

Working at ING in Italy As a trusted partner for millions of corporate and retail clients, ING is active in Italy with its two business lines: Wholesale & Retail Banking. Our almost 1,300 employees are spread across our office in Milan and our branches and stores in 16 cities. August 13, 2024 Article Overview Related Content Location Spotlight -

Working at ING in Luxembourg At ING Luxembourg, we are committed to innovation, sustainability, and excellence. As part of the global ING Group, we provide comprehensive financial services, including banking, investments, insurance, and pensions. August 13, 2024 Article Overview Related Content Location Spotlight

Working at ING in Luxembourg At ING Luxembourg, we are committed to innovation, sustainability, and excellence. As part of the global ING Group, we provide comprehensive financial services, including banking, investments, insurance, and pensions. August 13, 2024 Article Overview Related Content Location Spotlight -

Working at ING in the Philippines ING Hubs Philippines started in 2013 under the name of ING Global Shared Operations, offering in-house processing services for financial markets, lending, and trade and finance services (TFS) to some of ING’s Wholesale Banking branches in Asia. August 13, 2024 Article Related Content ING Hubs Location Spotlight

Working at ING in the Philippines ING Hubs Philippines started in 2013 under the name of ING Global Shared Operations, offering in-house processing services for financial markets, lending, and trade and finance services (TFS) to some of ING’s Wholesale Banking branches in Asia. August 13, 2024 Article Related Content ING Hubs Location Spotlight -

Working at ING in Poland At ING in Poland, we offer exciting opportunities across two main entities: ING Hubs Poland and ING Bank Śląski. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article Overview Related Content ING Hubs Location Spotlight

Working at ING in Poland At ING in Poland, we offer exciting opportunities across two main entities: ING Hubs Poland and ING Bank Śląski. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article Overview Related Content ING Hubs Location Spotlight -

Working at ING in Romania At ING in Romania, we offer exciting opportunities across two main entities: ING Hubs Romania and ING Bank Romania. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article Related Content ING Hubs Location Spotlight

Working at ING in Romania At ING in Romania, we offer exciting opportunities across two main entities: ING Hubs Romania and ING Bank Romania. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article Related Content ING Hubs Location Spotlight -

Working at ING in Spain We are a team of more than 1,600 people fuelled by the same purpose: doing our bit to help our clients create a better future for themselves, by providing them with the tools they need to get where they want to go. August 13, 2024 Article Overview Expertise & Teams Related Content Early Careers: Global Graduate Programme Location Spotlight

Working at ING in Spain We are a team of more than 1,600 people fuelled by the same purpose: doing our bit to help our clients create a better future for themselves, by providing them with the tools they need to get where they want to go. August 13, 2024 Article Overview Expertise & Teams Related Content Early Careers: Global Graduate Programme Location Spotlight -

Analytics International Talent Programme Dołącz do Global Analytics Graduate Programme w ING, aby przekształcać bankowość dzięki danym, z trzema rotacjami i globalnymi możliwościami nauki. August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Programmes

Analytics International Talent Programme Dołącz do Global Analytics Graduate Programme w ING, aby przekształcać bankowość dzięki danym, z trzema rotacjami i globalnymi możliwościami nauki. August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Programmes -

Working at ING in Slovakia Odkryj możliwości kariery w ING na Słowacji! Dołącz do zespołu poświęconego innowacjom i osobistemu rozwojowi w finansach. August 13, 2024 Article Overview Related Content ING Hubs Location Spotlight

Working at ING in Slovakia Odkryj możliwości kariery w ING na Słowacji! Dołącz do zespołu poświęconego innowacjom i osobistemu rozwojowi w finansach. August 13, 2024 Article Overview Related Content ING Hubs Location Spotlight -

August 13, 2024

August 13, 2024 -

Business Banking International Talent Programme Dołącz do programu International Talent Programme w ING. Odkryj trzy rotacje i rozpocznij swoją karierę w bankowości na świecie! August 13, 2024 Overview Students & Graduates Related Content Early Careers: Global Graduate Programme Early Careers: Local Opportunities

Business Banking International Talent Programme Dołącz do programu International Talent Programme w ING. Odkryj trzy rotacje i rozpocznij swoją karierę w bankowości na świecie! August 13, 2024 Overview Students & Graduates Related Content Early Careers: Global Graduate Programme Early Careers: Local Opportunities -

Philippines Hubs Odkryj ING Hubs Filipiny – globalne centrum IT, finansów, zarządzania ryzykiem i analityki danych, wspierające 40 krajów z ponad 4 800 pracownikami. August 13, 2024 Overview Related Content ING Hubs

Philippines Hubs Odkryj ING Hubs Filipiny – globalne centrum IT, finansów, zarządzania ryzykiem i analityki danych, wspierające 40 krajów z ponad 4 800 pracownikami. August 13, 2024 Overview Related Content ING Hubs -

Poland Hubs Odkryj różnorodne możliwości kariery w ING Hubs Polska, gdzie technologia, zarządzanie ryzykiem i analityka napędzają innowacje i doskonałość. August 13, 2024 Overview Related Content About ING Business ING Hubs

Poland Hubs Odkryj różnorodne możliwości kariery w ING Hubs Polska, gdzie technologia, zarządzanie ryzykiem i analityka napędzają innowacje i doskonałość. August 13, 2024 Overview Related Content About ING Business ING Hubs -

Romania Hubs Odkryj ekscytujące oferty pracy w ING Hubs Romania, oferujące role w obszarze technologii, ryzyka i danych, wspierające globalne innowacje i obsługę klienta. August 13, 2024 Overview Related Content ING Hubs

Romania Hubs Odkryj ekscytujące oferty pracy w ING Hubs Romania, oferujące role w obszarze technologii, ryzyka i danych, wspierające globalne innowacje i obsługę klienta. August 13, 2024 Overview Related Content ING Hubs -

Slovakia Hubs Odkryj możliwości kariery w ING Hubs Słowacja, gdzie wspieramy bankowość korporacyjną zaawansowanymi usługami w technologii, zarządzaniu ryzykiem i analityce. August 13, 2024 Article Related Content ING Hubs

Slovakia Hubs Odkryj możliwości kariery w ING Hubs Słowacja, gdzie wspieramy bankowość korporacyjną zaawansowanymi usługami w technologii, zarządzaniu ryzykiem i analityce. August 13, 2024 Article Related Content ING Hubs -

Turkiye Hubs Odkryj kariery w ING Hubs Türkiye, oferującym nowoczesne usługi technologiczne i analityczne. Dołącz do naszego zespołu ekspertów w dziedzinie technologii, zarządzania ryzykiem i analizy. August 13, 2024 Article Related Content ING Hubs

Turkiye Hubs Odkryj kariery w ING Hubs Türkiye, oferującym nowoczesne usługi technologiczne i analityczne. Dołącz do naszego zespołu ekspertów w dziedzinie technologii, zarządzania ryzykiem i analizy. August 13, 2024 Article Related Content ING Hubs -

Wholesale Banking w regionie EMEA Nasze największe regiony Wholesale Banking, obejmujące 23 kraje, służą jako brama do Europy dla amerykańskich i azjatyckich międzynarodowych korporacji. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking

Wholesale Banking w regionie EMEA Nasze największe regiony Wholesale Banking, obejmujące 23 kraje, służą jako brama do Europy dla amerykańskich i azjatyckich międzynarodowych korporacji. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking -

Finance International Talent Programme Doe mee aan het Finance International Talent Programme van ING. Verken drie rotaties en stimuleer duurzame groei in je bankcarrière! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme

Finance International Talent Programme Doe mee aan het Finance International Talent Programme van ING. Verken drie rotaties en stimuleer duurzame groei in je bankcarrière! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme -

Wholesale Banking w regionie APAC Nasz zasięg Wholesale Banking w regionie APAC obejmuje Hongkong, Pekin, Szanghaj, Tajwan, Koreę Południową, Japonię, Indonezję, Indie, Filipiny i Wietnam. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking Location Spotlight

Wholesale Banking w regionie APAC Nasz zasięg Wholesale Banking w regionie APAC obejmuje Hongkong, Pekin, Szanghaj, Tajwan, Koreę Południową, Japonię, Indonezję, Indie, Filipiny i Wietnam. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking Location Spotlight -

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme -

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme -

Retail Banking International Talent Programme Dołącz do Programu Talentów w ING! Wpływaj na miliony dzięki trzem rotacjom i rozpocznij swoją międzynarodową karierę. August 13, 2024 Article Students & Graduates Related Content Retail Banking Early Careers: Global Graduate Programme

Retail Banking International Talent Programme Dołącz do Programu Talentów w ING! Wpływaj na miliony dzięki trzem rotacjom i rozpocznij swoją międzynarodową karierę. August 13, 2024 Article Students & Graduates Related Content Retail Banking Early Careers: Global Graduate Programme -

Risk International Talent Programme Dołącz do Programu Talentów w ING! Opracuj strategie zarządzania ryzykiem i rozpocznij międzynarodową karierę w trzech rotacjach. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme

Risk International Talent Programme Dołącz do Programu Talentów w ING! Opracuj strategie zarządzania ryzykiem i rozpocznij międzynarodową karierę w trzech rotacjach. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme -

Tech International Talent Programme Dołącz do Programu Talentów w ING! Kształtuj przyszłość bankowości dzięki innowacyjnej technologii i trzem wpływowym rotacjom. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme Early Careers: Local Opportunities

Tech International Talent Programme Dołącz do Programu Talentów w ING! Kształtuj przyszłość bankowości dzięki innowacyjnej technologii i trzem wpływowym rotacjom. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme Early Careers: Local Opportunities -

Wholesale Banking International Talent Programme Dołącz do Programu Talentów w ING! Zostań zaufanym doradcą dla dużych klientów i rozpocznij karierę w trzech rotacjach. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme

Wholesale Banking International Talent Programme Dołącz do Programu Talentów w ING! Zostań zaufanym doradcą dla dużych klientów i rozpocznij karierę w trzech rotacjach. August 13, 2024 Article Students & Graduates Related Content Early Careers: Global Graduate Programme -

Różnorodność, integracja i przynależność ING wspiera kulturę różnorodności, integracji i przynależności w sześciu wymiarach - niepełnosprawności, płci, pokoleń, LGBTQI+, rasy i pochodzenia etnicznego oraz kultury - na całym świecie. August 14, 2024 Article Diversity, Inclusion & Belonging

Różnorodność, integracja i przynależność ING wspiera kulturę różnorodności, integracji i przynależności w sześciu wymiarach - niepełnosprawności, płci, pokoleń, LGBTQI+, rasy i pochodzenia etnicznego oraz kultury - na całym świecie. August 14, 2024 Article Diversity, Inclusion & Belonging -

Bezpieczeństwo Chroń naszych ludzi, zasoby i informacje przed zagrożeniami. Stój na straży naszego bezpieczeństwa. August 21, 2024 Article Expertise & Teams Related Content Employee Stories

Bezpieczeństwo Chroń naszych ludzi, zasoby i informacje przed zagrożeniami. Stój na straży naszego bezpieczeństwa. August 21, 2024 Article Expertise & Teams Related Content Employee Stories -

Benefity w ING Banku Śląskim Poznaj ofertę benefitową ING Banku Śląskiego November 19, 2024 Overview Benefits

Benefity w ING Banku Śląskim Poznaj ofertę benefitową ING Banku Śląskiego November 19, 2024 Overview Benefits -

Spółki i fundacje GK ING Bank Śląski Poznaj spółki i fundacje Grupy Kapitałowej ING Banku Śląskiego. November 22, 2024 Article Expertise & Teams

Spółki i fundacje GK ING Bank Śląski Poznaj spółki i fundacje Grupy Kapitałowej ING Banku Śląskiego. November 22, 2024 Article Expertise & Teams -

Biura i lokalizacje ING Bank Śląski Sprawdź gdzie mieszczą się nasze biurowce i jak wyglądają nasze biura. March 03, 2025 Article Overview Related Content Events Early Careers: Local Opportunities Location Spotlight Events Blog

Biura i lokalizacje ING Bank Śląski Sprawdź gdzie mieszczą się nasze biurowce i jak wyglądają nasze biura. March 03, 2025 Article Overview Related Content Events Early Careers: Local Opportunities Location Spotlight Events Blog -

November 25, 2024

November 25, 2024 -

Program ChallengING Program ChallengING w ING Banku Śląskim S.A. oferuje niezwykłą szansę dla osób, które właśnie ukończyły studia lub znajdują się na ich końcowym etapie. November 27, 2024 Overview Students & Graduates Early Careers: Local Opportunities

Program ChallengING Program ChallengING w ING Banku Śląskim S.A. oferuje niezwykłą szansę dla osób, które właśnie ukończyły studia lub znajdują się na ich końcowym etapie. November 27, 2024 Overview Students & Graduates Early Careers: Local Opportunities -

Staż w ING Bank Śląski Poznaj możliwości rozwoju kariery na stażu w ING Banku Śląskim. November 29, 2024 Overview Students & Graduates Early Careers: Local Opportunities

Staż w ING Bank Śląski Poznaj możliwości rozwoju kariery na stażu w ING Banku Śląskim. November 29, 2024 Overview Students & Graduates Early Careers: Local Opportunities -

January 22, 2025 Article Overview Culture Diversity, Inclusion & Belonging Students & Graduates Early Careers: Local Opportunities Events

January 22, 2025 Article Overview Culture Diversity, Inclusion & Belonging Students & Graduates Early Careers: Local Opportunities Events -

January 16, 2025

January 16, 2025 -

Wholesale Banking in Americas Dołącz do Wholesale Banking w ING w Amerykach, gdzie oferujemy innowacyjne rozwiązania finansowe dla klientów korporacyjnych w dużych miastach. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking

Wholesale Banking in Americas Dołącz do Wholesale Banking w ING w Amerykach, gdzie oferujemy innowacyjne rozwiązania finansowe dla klientów korporacyjnych w dużych miastach. August 13, 2024 Article Expertise & Teams Related Content Wholesale Banking -

Meet Up CIO w ING Banku Śląskim MeetUp Pionu CIO to doskonała okazja dla wszystkich osób zainteresowanych poznaniem tego, jak działa technologiczne serce banku, a więc Pion CIO. March 11, 2025 Article Overview Expertise & Teams Students & Graduates Events Events

Meet Up CIO w ING Banku Śląskim MeetUp Pionu CIO to doskonała okazja dla wszystkich osób zainteresowanych poznaniem tego, jak działa technologiczne serce banku, a więc Pion CIO. March 11, 2025 Article Overview Expertise & Teams Students & Graduates Events Events -

Expert Team Experience Design Projektujemy interfejsy systemów, z których korzystają pracownicy naszego banku. Makietujemy, warsztatujemy i zbieramy feedback od przyszłych użytkowników i użytkowniczek May 08, 2025 Early Careers: Local Opportunities Events

Expert Team Experience Design Projektujemy interfejsy systemów, z których korzystają pracownicy naszego banku. Makietujemy, warsztatujemy i zbieramy feedback od przyszłych użytkowników i użytkowniczek May 08, 2025 Early Careers: Local Opportunities Events

Oferty pracy

No jobs viewed

No jobs saved

Oferty pracy

- Polecane

- Ostatnio przeglądane

- Polubione oferty

No jobs viewed

No jobs saved