Team Lead IRB Model Development

Szczegóły zadania

We are looking for you, if you:

have experience in team management,

have experience in Stakeholders Management, and you are able to build strong relationship with Customers based on trust,

are able to support internal and external customers to meet and understand their needs and expectations,

have experience in building, updating and maintaining credit risk models, especially compliant with IRB requirements,

have understanding of key regulations in the area of credit risk model development and monitoring,

have sound knowledge of statistical modelling and econometric methods,

have at least 5 years of experience with credit risk management and/or modelling,

You have excellent (English) verbal and written communication skills.

You'll get extra points for:

Experience with statistical programming (Python and SAS are preferred) and building automation solutions for model monitoring

Experience with corporate banking products, risk management and models,

Experience and knowledge on agile way of working,

Professional certification FRM/PRM/CFA or CQF,

Strong analytical and problem-solving capabilities,

Independent, creative and pro-active mind-set,

Keen on innovation,

Analytical and critical attitude,

Experience with building standards and templates for annual models monitoring

Your responsibilities:

Share knowledge and make sure team members have appropriate competencies and skills,

Planning, coaching, assessing and professionalizing your team members,

Recruiting and onboarding new talents,

Support your teams in developing/monitoring credit risk models,

Assure quality of teams deliverables,

Interacting with stakeholders,

Information about the squad:

The Model Development department is an international team of 300 highly qualified professionals. Our expertise lies in the development and management of credit risk, ALM and operational risk models. The Risk Hub Model Development team performs model development activities for models throughout ING, working closely together on international projects with the teams in Amsterdam. The developed credit risk models are core to the success of ING and include IRB and IFRS9 models (PD, LGD, EAD) for retail and wholesale portfolios, as well as non-regulatory models. The models are used by all local Risk Management units within ING. As a Chapter Lead in credit risk modelling, you will be given the opportunity to apply and broaden your experience in management and credit risk modelling topics, using state-of-the-art modelling methods, tooling and data processing technologies.

Your place of work

Explore the area

Your place of work

Explore the area

Questions? Just ask

ING Recruitment team

W ING chcemy, aby każdy mógł w pełni wykorzystać swój potencjał. Tworzymy inkluzywną kulturę, w której każdy ma szansę na rozwój i wpływ na naszych klientów oraz społeczeństwo. Zawsze wspieramy różnorodność, równość i integrację. Nie tolerujemy żadnej formy dyskryminacji, czy to z powodu wieku, płci, tożsamości płciowej, kultury, doświadczenia, religii, rasy, niepełnosprawności, obowiązków rodzinnych, orientacji seksualnej lub czegokolwiek innego. Jeśli potrzebujesz wsparcia lub dostosowania podczas procesu rekrutacji lub rozmowy, skontaktuj się z rekruterem wskazanym w ogłoszeniu. Z przyjemnością pomożemy Ci, aby proces był sprawiedliwy i dostępny. Dowiedz się więcej o naszym zaangażowaniu na rzecz różnorodności i integracji tutaj.

Więcej informacji

-

Spotkajmy się! Come see us in person! May 02, 2024 Events

Spotkajmy się! Come see us in person! May 02, 2024 Events -

Bankowość detaliczna Dołącz do ING w Bankowości Detalicznej, aby wspierać klientów w podejmowaniu mądrych decyzji finansowych w cyfrowym świecie.

Bankowość detaliczna Dołącz do ING w Bankowości Detalicznej, aby wspierać klientów w podejmowaniu mądrych decyzji finansowych w cyfrowym świecie.

May 15, 2024 Article Expertise & Teams Retail Banking Related Content -

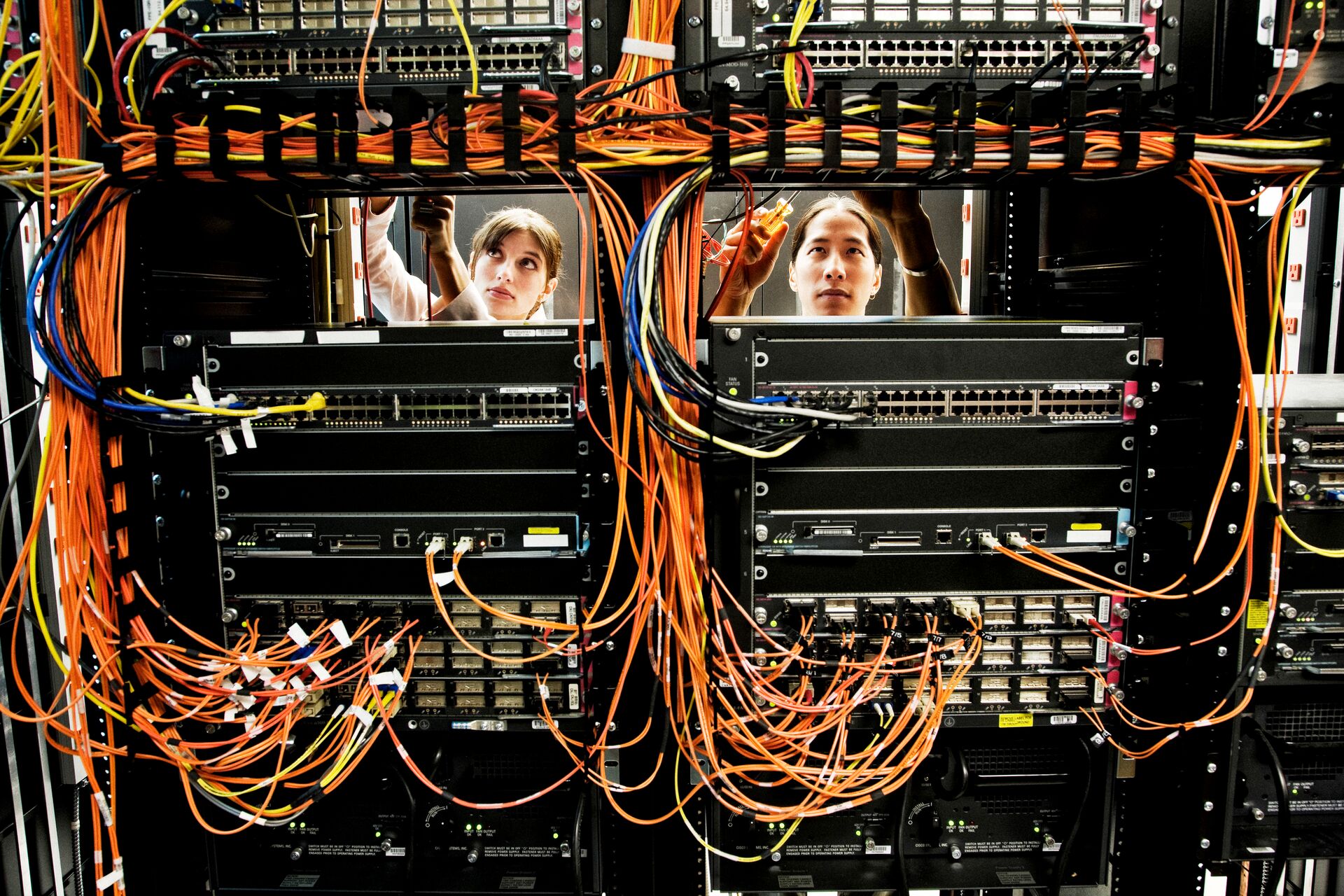

Pion Tech Wprowadzaj innowacje i zarządzaj naszą infrastrukturą technologiczną, aby wspierać rozwój biznesu. Bądź technologicznym guru napędzającym naszą cyfrową ewolucję. May 15, 2024 Article Expertise & Teams

Pion Tech Wprowadzaj innowacje i zarządzaj naszą infrastrukturą technologiczną, aby wspierać rozwój biznesu. Bądź technologicznym guru napędzającym naszą cyfrową ewolucję. May 15, 2024 Article Expertise & Teams -

Pion Ryzyka Identyfikuj, oceniaj i ograniczaj ryzyko, aby chronić nasze zasoby. Zapewniaj naszej organizacji funkcjonowanie zgodne z naszym apetytem na ryzyko. May 15, 2024 Article Overview Expertise & Teams

Pion Ryzyka Identyfikuj, oceniaj i ograniczaj ryzyko, aby chronić nasze zasoby. Zapewniaj naszej organizacji funkcjonowanie zgodne z naszym apetytem na ryzyko. May 15, 2024 Article Overview Expertise & Teams -

ING Hubs Dołącz do ING Hubs i kształtuj transformację cyfrową w bankowości. Odkryj różnorodne możliwości w naszej globalnej sieci!

ING Hubs Dołącz do ING Hubs i kształtuj transformację cyfrową w bankowości. Odkryj różnorodne możliwości w naszej globalnej sieci!

May 15, 2024 Overview ING Hubs -

Informacje o ING Dołącz do ING, globalnego banku wspierającego ludzi i firmy. Ciesz się zróżnicowaną, inkluzywną kulturą z elastycznymi możliwościami pracy i rozwoju. June 28, 2024 Article Culture

Informacje o ING Dołącz do ING, globalnego banku wspierającego ludzi i firmy. Ciesz się zróżnicowaną, inkluzywną kulturą z elastycznymi możliwościami pracy i rozwoju. June 28, 2024 Article Culture -

Wholesale Banking Uczestnicz w zapewnieniu naszym klientom i klientkom najlepszych usług finansowych.

Wholesale Banking Uczestnicz w zapewnieniu naszym klientom i klientkom najlepszych usług finansowych.

August 12, 2024 Article Expertise & Teams Wholesale Banking Related Content -

Audyt Dbamy o uczciwość i przejrzystość naszych operacji finansowych, zapewniając zgodność z przepisami i identyfikując obszary wymagające poprawy. Bądź na straży i chroń zdrowie naszej organizacji. August 12, 2024 Article Expertise & Teams

Audyt Dbamy o uczciwość i przejrzystość naszych operacji finansowych, zapewniając zgodność z przepisami i identyfikując obszary wymagające poprawy. Bądź na straży i chroń zdrowie naszej organizacji. August 12, 2024 Article Expertise & Teams -

Wsparcie biznesowe i zarządzanie biznesem Pomóż w zapewnieniu naszym zespołom płynnego wsparcia operacyjnego i zarządzania strategicznego. Bądź jednym z filarów sprawnego i wydajnego funkcjonowania naszej firmy. August 12, 2024 Article Expertise & Teams

Wsparcie biznesowe i zarządzanie biznesem Pomóż w zapewnieniu naszym zespołom płynnego wsparcia operacyjnego i zarządzania strategicznego. Bądź jednym z filarów sprawnego i wydajnego funkcjonowania naszej firmy. August 12, 2024 Article Expertise & Teams -

Pion klienta detalicznego i biznesowego Zwiększ satysfakcję klientów i klientek usprawniając procesy biznesowe. Bądź zaufanym partnerem, zapewniającym wysoką jakość każdej interakcji. August 12, 2024 Article Expertise & Teams Related Content

Pion klienta detalicznego i biznesowego Zwiększ satysfakcję klientów i klientek usprawniając procesy biznesowe. Bądź zaufanym partnerem, zapewniającym wysoką jakość każdej interakcji. August 12, 2024 Article Expertise & Teams Related Content -

Komunikacja i marketing Kształtuj naszą narrację i twórz niezapomniane doświadczenia związane z marką. Bądź głosem, który urzeka i obrazem, który zapada w pamięć. August 12, 2024 Article Expertise & Teams

Komunikacja i marketing Kształtuj naszą narrację i twórz niezapomniane doświadczenia związane z marką. Bądź głosem, który urzeka i obrazem, który zapada w pamięć. August 12, 2024 Article Expertise & Teams -

Compliance Pomóż w dbaniu o przestrzeganie przepisów i utrzymywaniu najwyższych standardów etycznych. Stań na straży spełniania wymogów regulacyjnych. August 12, 2024 Article Expertise & Teams Related Content

Compliance Pomóż w dbaniu o przestrzeganie przepisów i utrzymywaniu najwyższych standardów etycznych. Stań na straży spełniania wymogów regulacyjnych. August 12, 2024 Article Expertise & Teams Related Content -

Zarządzanie bezpieczeństwem obiektów Zarządzaj naszymi środowiskami fizycznymi i organizacyjnymi, aby zoptymalizować wydajność. Bądź twórcą przestrzeni, w których powstają innowacje. August 12, 2024 Article Expertise & Teams Related Content

Zarządzanie bezpieczeństwem obiektów Zarządzaj naszymi środowiskami fizycznymi i organizacyjnymi, aby zoptymalizować wydajność. Bądź twórcą przestrzeni, w których powstają innowacje. August 12, 2024 Article Expertise & Teams Related Content -

Customer Experience Ulepszaj interakcje z odbiorcami naszych usług, aby tworzyć wyjątkowe ścieżki klienta/klientki. Buduj z nami satysfakcję i lojalność klientów. August 12, 2024 Article Expertise & Teams Related Content

Customer Experience Ulepszaj interakcje z odbiorcami naszych usług, aby tworzyć wyjątkowe ścieżki klienta/klientki. Buduj z nami satysfakcję i lojalność klientów. August 12, 2024 Article Expertise & Teams Related Content -

Modelowanie i analiza danych Wykorzystaj dane, aby wyciągnąć wnioski i pomóc w podejmowaniu decyzji. Bądź potęgą analityczną napędzającą nasze strategiczne działania. August 12, 2024 Article Expertise & Teams Related Content

Modelowanie i analiza danych Wykorzystaj dane, aby wyciągnąć wnioski i pomóc w podejmowaniu decyzji. Bądź potęgą analityczną napędzającą nasze strategiczne działania. August 12, 2024 Article Expertise & Teams Related Content -

Finanse Pomóż w zarządzaniu naszą kondycją finansową i kieruj naszymi strategiami gospodarczymi. Bądź ekspertem finansowym / ekspertką finansową, który / która zapewni nam powodzenie. August 12, 2024 Article Expertise & Teams Related Content

Finanse Pomóż w zarządzaniu naszą kondycją finansową i kieruj naszymi strategiami gospodarczymi. Bądź ekspertem finansowym / ekspertką finansową, który / która zapewni nam powodzenie. August 12, 2024 Article Expertise & Teams Related Content -

Human Resources Pomagaj naszym pracownikom i pracowniczkom w rozwijaniu kompetencji i wspieraj angażującą kulturę pracy. Bądź mistrzem / mistrzynią rozwijania potencjału. August 12, 2024 Article Expertise & Teams Related Content

Human Resources Pomagaj naszym pracownikom i pracowniczkom w rozwijaniu kompetencji i wspieraj angażującą kulturę pracy. Bądź mistrzem / mistrzynią rozwijania potencjału. August 12, 2024 Article Expertise & Teams Related Content -

Departament Skarbu Nadzoruj nasze zarządzanie płynnością i kapitałem, aby zapewnić stabilność finansową. Bądź osobą odpowiedzialną za strategię zarządzającą naszymi zasobami finansowymi. August 12, 2024 Article Expertise & Teams Related Content

Departament Skarbu Nadzoruj nasze zarządzanie płynnością i kapitałem, aby zapewnić stabilność finansową. Bądź osobą odpowiedzialną za strategię zarządzającą naszymi zasobami finansowymi. August 12, 2024 Article Expertise & Teams Related Content -

Innowacje Twórz przyszłościowe rozwiązania i przełomowe inicjatywy. Wyznaczaj nowe ścieżki i prowadź naszą organizację w przyszłość. August 12, 2024 Article Expertise & Teams Related Content

Innowacje Twórz przyszłościowe rozwiązania i przełomowe inicjatywy. Wyznaczaj nowe ścieżki i prowadź naszą organizację w przyszłość. August 12, 2024 Article Expertise & Teams Related Content -

Know Your Customer Upewnij się, że rozumiemy i spełniamy potrzeby naszych klientów i klientek, przestrzegając przepisów. Spraw, abyśmy znali naszych klientów możliwie jak najlepiej. August 12, 2024 Article Expertise & Teams Related Content

Know Your Customer Upewnij się, że rozumiemy i spełniamy potrzeby naszych klientów i klientek, przestrzegając przepisów. Spraw, abyśmy znali naszych klientów możliwie jak najlepiej. August 12, 2024 Article Expertise & Teams Related Content -

Departament Prawny Udzielaj specjalistycznych porad prawnych i monitoruj zmiany w prawie powszechnie obowiązującym. Pomóż zapewnić rozwój naszej firmy zgodny z przepisami.

Departament Prawny Udzielaj specjalistycznych porad prawnych i monitoruj zmiany w prawie powszechnie obowiązującym. Pomóż zapewnić rozwój naszej firmy zgodny z przepisami.

August 12, 2024 Article Expertise & Teams Related Content -

Leadership Inspiruj zespoły i kieruj realizacją naszej wizji przyszłości. Wnieś naszą organizację na nowy poziom August 12, 2024 Article Expertise & Teams Related Content

Leadership Inspiruj zespoły i kieruj realizacją naszej wizji przyszłości. Wnieś naszą organizację na nowy poziom August 12, 2024 Article Expertise & Teams Related Content -

Zakupy Optymalizuj nasze procesy zakupowe i zabezpiecz zasoby wysokiej jakości. Negocjuj to, co najlepsze dla naszej firmy. August 12, 2024 Article Expertise & Teams Related Content

Zakupy Optymalizuj nasze procesy zakupowe i zabezpiecz zasoby wysokiej jakości. Negocjuj to, co najlepsze dla naszej firmy. August 12, 2024 Article Expertise & Teams Related Content -

Bankowość biznesowa Buduj i pielęgnuj trwałe relacje z naszymi partnerami biznesowymi. Buduj zaufanie i współpracę. August 12, 2024 Article Expertise & Teams Related Content

Bankowość biznesowa Buduj i pielęgnuj trwałe relacje z naszymi partnerami biznesowymi. Buduj zaufanie i współpracę. August 12, 2024 Article Expertise & Teams Related Content -

Transformacja Zarządzaj zmianami, które wspierają realizację naszych celów strategicznych. August 12, 2024 Article Expertise & Teams Related Content

Transformacja Zarządzaj zmianami, które wspierają realizację naszych celów strategicznych. August 12, 2024 Article Expertise & Teams Related Content -

International Talent Programme Rozpocznij swoją karierę w ING w ramach Międzynarodowego Programu Talentów: globalne rotacje, rozwój osobisty i różne obszary bankowości. August 13, 2024 Overview Early Careers: Global Graduate Programme Programmes

International Talent Programme Rozpocznij swoją karierę w ING w ramach Międzynarodowego Programu Talentów: globalne rotacje, rozwój osobisty i różne obszary bankowości. August 13, 2024 Overview Early Careers: Global Graduate Programme Programmes -

Wholesale Banking Dołącz do zespołu Wholesale Banking w ING, wspierając klientów korporacyjnych w strategii i efektywnych rozwiązaniach bankowych na całym świecie. August 13, 2024 Overview Expertise & Teams Wholesale Banking Related Content

Wholesale Banking Dołącz do zespołu Wholesale Banking w ING, wspierając klientów korporacyjnych w strategii i efektywnych rozwiązaniach bankowych na całym świecie. August 13, 2024 Overview Expertise & Teams Wholesale Banking Related Content -

Lokalizacje Odkryj lokalizacje ING w ponad 40 krajach! Znajdź możliwości kariery w regionach Ameryk, EMEA i APAC.

Lokalizacje Odkryj lokalizacje ING w ponad 40 krajach! Znajdź możliwości kariery w regionach Ameryk, EMEA i APAC.

August 13, 2024 Overview Expertise & Teams Related Content -

Expertise & Teams W ING nasze zróżnicowane zespoły wyróżniają się we wszystkich sektorach bankowości. Od bankowości detalicznej po bankowość hurtową, zarządzanie ryzykiem i technologię, zapewniamy dostosowane rozwiązania i innowacyjne strategie. August 13, 2024 Overview Expertise & Teams Related Content

Expertise & Teams W ING nasze zróżnicowane zespoły wyróżniają się we wszystkich sektorach bankowości. Od bankowości detalicznej po bankowość hurtową, zarządzanie ryzykiem i technologię, zapewniamy dostosowane rozwiązania i innowacyjne strategie. August 13, 2024 Overview Expertise & Teams Related Content -

Working at ING Working at ING means working with great people: friendly, collaborative and (we think) fun! We empower the people around us and our customers to stay a step ahead. A job at ING comes with autonomy and the expectation to drive progress, deliver a superior customer experience and create a more sustainable future for people and planet. August 13, 2024 Article Culture

Working at ING Working at ING means working with great people: friendly, collaborative and (we think) fun! We empower the people around us and our customers to stay a step ahead. A job at ING comes with autonomy and the expectation to drive progress, deliver a superior customer experience and create a more sustainable future for people and planet. August 13, 2024 Article Culture -

Early Careers Odkryj Early Careers w ING z programami dla trainee, stażami i kursami IT, które mają na celu rozbudzenie pasji i rozwój. August 13, 2024 Overview Students & Graduates Related Content

Early Careers Odkryj Early Careers w ING z programami dla trainee, stażami i kursami IT, które mają na celu rozbudzenie pasji i rozwój. August 13, 2024 Overview Students & Graduates Related Content -

Praca w ING w Holandii August 13, 2024 Article Overview Location Spotlight Related Content

Praca w ING w Holandii August 13, 2024 Article Overview Location Spotlight Related Content -

Praca w ING w Australii Over 20 years ago, we launched the country’s first high-interest, fee-free online savings account. Today, we continue to lead with innovative products like home loans, superannuation, credit cards, and more. August 13, 2024 Article Overview Location Spotlight Related Content

Praca w ING w Australii Over 20 years ago, we launched the country’s first high-interest, fee-free online savings account. Today, we continue to lead with innovative products like home loans, superannuation, credit cards, and more. August 13, 2024 Article Overview Location Spotlight Related Content -

Praca w ING Belgii With over 6,000 employees in Belgium, we’re a significant employer. Research shows that our vibrant ‘orange’ culture sets us apart. We offer impactful roles in an inclusive and collaborative work environment, competitive benefits, great flexibility thanks to our hybrid work model and opportunities to grow your career. August 13, 2024 Article Overview Location Spotlight Employee Stories Related Content

Praca w ING Belgii With over 6,000 employees in Belgium, we’re a significant employer. Research shows that our vibrant ‘orange’ culture sets us apart. We offer impactful roles in an inclusive and collaborative work environment, competitive benefits, great flexibility thanks to our hybrid work model and opportunities to grow your career. August 13, 2024 Article Overview Location Spotlight Employee Stories Related Content -

Working at ING in Germany We’ve got over 9 million customers in Germany who trust us, making us the third largest bank in the country. Our core business includes savings accounts, mortgages, investment products, consumer loans and current accounts for private customers. August 13, 2024 Article Overview Culture Expertise & Teams Students & Graduates Benefits ING Hubs Early Careers: Global Graduate Programme Early Careers: Local Opportunities Location Spotlight Employee Stories

Working at ING in Germany We’ve got over 9 million customers in Germany who trust us, making us the third largest bank in the country. Our core business includes savings accounts, mortgages, investment products, consumer loans and current accounts for private customers. August 13, 2024 Article Overview Culture Expertise & Teams Students & Graduates Benefits ING Hubs Early Careers: Global Graduate Programme Early Careers: Local Opportunities Location Spotlight Employee Stories -

Praca w ING we Włoszech As a trusted partner for millions of corporate and retail clients, ING is active in Italy with its two business lines: Wholesale & Retail Banking. Our almost 1,300 employees are spread across our office in Milan and our branches and stores in 16 cities. August 13, 2024 Article Overview Location Spotlight Related Content

Praca w ING we Włoszech As a trusted partner for millions of corporate and retail clients, ING is active in Italy with its two business lines: Wholesale & Retail Banking. Our almost 1,300 employees are spread across our office in Milan and our branches and stores in 16 cities. August 13, 2024 Article Overview Location Spotlight Related Content -

Praca w ING w Luksemburgu At ING Luxembourg, we are committed to innovation, sustainability, and excellence. As part of the global ING Group, we provide comprehensive financial services, including banking, investments, insurance, and pensions. August 13, 2024 Article Overview Location Spotlight Related Content

Praca w ING w Luksemburgu At ING Luxembourg, we are committed to innovation, sustainability, and excellence. As part of the global ING Group, we provide comprehensive financial services, including banking, investments, insurance, and pensions. August 13, 2024 Article Overview Location Spotlight Related Content -

Praca w ING na Filipinach ING Hubs Philippines started in 2013 under the name of ING Global Shared Operations, offering in-house processing services for financial markets, lending, and trade and finance services (TFS) to some of ING’s Wholesale Banking branches in Asia. August 13, 2024 Article ING Hubs Location Spotlight Related Content

Praca w ING na Filipinach ING Hubs Philippines started in 2013 under the name of ING Global Shared Operations, offering in-house processing services for financial markets, lending, and trade and finance services (TFS) to some of ING’s Wholesale Banking branches in Asia. August 13, 2024 Article ING Hubs Location Spotlight Related Content -

Praca w ING w Polsce Dowiedz się więcej o pracy w ING w Polsce. August 13, 2024 Article Overview ING Hubs Location Spotlight Related Content

Praca w ING w Polsce Dowiedz się więcej o pracy w ING w Polsce. August 13, 2024 Article Overview ING Hubs Location Spotlight Related Content -

Praca w ING w Rumunii At ING in Romania, we offer exciting opportunities across two main entities: ING Hubs Romania and ING Bank Romania. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article ING Hubs Location Spotlight Related Content

Praca w ING w Rumunii At ING in Romania, we offer exciting opportunities across two main entities: ING Hubs Romania and ING Bank Romania. Together, they form a critical part of ING’s global operations, driving innovation, customer service excellence, and sustainable finance. August 13, 2024 Article ING Hubs Location Spotlight Related Content -

Analytics International Talent Programme Dołącz do Global Analytics Graduate Programme w ING, aby przekształcać bankowość dzięki danym, z trzema rotacjami i globalnymi możliwościami nauki. August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Programmes

Analytics International Talent Programme Dołącz do Global Analytics Graduate Programme w ING, aby przekształcać bankowość dzięki danym, z trzema rotacjami i globalnymi możliwościami nauki. August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Programmes -

Working at ING in Slovakia Odkryj możliwości kariery w ING na Słowacji! Dołącz do zespołu poświęconego innowacjom i osobistemu rozwojowi w finansach.

Working at ING in Slovakia Odkryj możliwości kariery w ING na Słowacji! Dołącz do zespołu poświęconego innowacjom i osobistemu rozwojowi w finansach.

August 13, 2024 Article Overview ING Hubs Location Spotlight Related Content -

Cookie policy August 13, 2024 Overview

Cookie policy August 13, 2024 Overview -

Business Banking International Talent Programme Dołącz do programu International Talent Programme w ING. Odkryj trzy rotacje i rozpocznij swoją karierę w bankowości na świecie! August 13, 2024 Overview Students & Graduates Early Careers: Global Graduate Programme Early Careers: Local Opportunities Related Content

Business Banking International Talent Programme Dołącz do programu International Talent Programme w ING. Odkryj trzy rotacje i rozpocznij swoją karierę w bankowości na świecie! August 13, 2024 Overview Students & Graduates Early Careers: Global Graduate Programme Early Careers: Local Opportunities Related Content -

Philippines Hubs Odkryj ING Hubs Filipiny – globalne centrum IT, finansów, zarządzania ryzykiem i analityki danych, wspierające 40 krajów z ponad 4 800 pracownikami. August 13, 2024 Overview ING Hubs Related Content

Philippines Hubs Odkryj ING Hubs Filipiny – globalne centrum IT, finansów, zarządzania ryzykiem i analityki danych, wspierające 40 krajów z ponad 4 800 pracownikami. August 13, 2024 Overview ING Hubs Related Content -

Poland Hubs Odkryj różnorodne możliwości kariery w ING Hubs Polska, gdzie technologia, zarządzanie ryzykiem i analityka napędzają innowacje i doskonałość. August 13, 2024 Overview About ING Business ING Hubs Related Content

Poland Hubs Odkryj różnorodne możliwości kariery w ING Hubs Polska, gdzie technologia, zarządzanie ryzykiem i analityka napędzają innowacje i doskonałość. August 13, 2024 Overview About ING Business ING Hubs Related Content -

Romania Hubs Odkryj ekscytujące oferty pracy w ING Hubs Romania, oferujące role w obszarze technologii, ryzyka i danych, wspierające globalne innowacje i obsługę klienta. August 13, 2024 Overview ING Hubs Related Content

Romania Hubs Odkryj ekscytujące oferty pracy w ING Hubs Romania, oferujące role w obszarze technologii, ryzyka i danych, wspierające globalne innowacje i obsługę klienta. August 13, 2024 Overview ING Hubs Related Content -

Slovakia Hubs Odkryj możliwości kariery w ING Hubs Słowacja, gdzie wspieramy bankowość korporacyjną zaawansowanymi usługami w technologii, zarządzaniu ryzykiem i analityce.

Slovakia Hubs Odkryj możliwości kariery w ING Hubs Słowacja, gdzie wspieramy bankowość korporacyjną zaawansowanymi usługami w technologii, zarządzaniu ryzykiem i analityce.

August 13, 2024 Article ING Hubs Related Content -

Turkiye Hubs Odkryj kariery w ING Hubs Türkiye, oferującym nowoczesne usługi technologiczne i analityczne. Dołącz do naszego zespołu ekspertów w dziedzinie technologii, zarządzania ryzykiem i analizy. August 13, 2024 Article ING Hubs Related Content

Turkiye Hubs Odkryj kariery w ING Hubs Türkiye, oferującym nowoczesne usługi technologiczne i analityczne. Dołącz do naszego zespołu ekspertów w dziedzinie technologii, zarządzania ryzykiem i analizy. August 13, 2024 Article ING Hubs Related Content -

Wholesale Banking w regionie EMEA Nasze największe regiony Wholesale Banking, obejmujące 23 kraje, służą jako brama do Europy dla amerykańskich i azjatyckich międzynarodowych korporacji. August 13, 2024 Article Expertise & Teams Wholesale Banking Related Content

Wholesale Banking w regionie EMEA Nasze największe regiony Wholesale Banking, obejmujące 23 kraje, służą jako brama do Europy dla amerykańskich i azjatyckich międzynarodowych korporacji. August 13, 2024 Article Expertise & Teams Wholesale Banking Related Content -

Finance International Talent Programme Doe mee aan het Finance International Talent Programme van ING. Verken drie rotaties en stimuleer duurzame groei in je bankcarrière! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content

Finance International Talent Programme Doe mee aan het Finance International Talent Programme van ING. Verken drie rotaties en stimuleer duurzame groei in je bankcarrière! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content -

Wholesale Banking w regionie APAC Nasz zasięg Wholesale Banking w regionie APAC obejmuje Hongkong, Pekin, Szanghaj, Tajwan, Koreę Południową, Japonię, Indonezję, Indie, Filipiny i Wietnam. August 13, 2024 Article Expertise & Teams Wholesale Banking Location Spotlight Related Content

Wholesale Banking w regionie APAC Nasz zasięg Wholesale Banking w regionie APAC obejmuje Hongkong, Pekin, Szanghaj, Tajwan, Koreę Południową, Japonię, Indonezję, Indie, Filipiny i Wietnam. August 13, 2024 Article Expertise & Teams Wholesale Banking Location Spotlight Related Content -

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content -

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content

Human Resources International Talent Programme Dołącz do programu HR International Talent w ING. Realizuj istotne projekty i kształtuj strategię HR na początku swojej kariery! August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content -

Retail Banking International Talent Programme Dołącz do Programu Talentów w ING! Wpływaj na miliony dzięki trzem rotacjom i rozpocznij swoją międzynarodową karierę. August 13, 2024 Article Students & Graduates Retail Banking Early Careers: Global Graduate Programme Related Content

Retail Banking International Talent Programme Dołącz do Programu Talentów w ING! Wpływaj na miliony dzięki trzem rotacjom i rozpocznij swoją międzynarodową karierę. August 13, 2024 Article Students & Graduates Retail Banking Early Careers: Global Graduate Programme Related Content -

Risk International Talent Programme Dołącz do Programu Talentów w ING! Opracuj strategie zarządzania ryzykiem i rozpocznij międzynarodową karierę w trzech rotacjach.

Risk International Talent Programme Dołącz do Programu Talentów w ING! Opracuj strategie zarządzania ryzykiem i rozpocznij międzynarodową karierę w trzech rotacjach.

August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content -

Tech International Talent Programme Dołącz do Programu Talentów w ING! Kształtuj przyszłość bankowości dzięki innowacyjnej technologii i trzem wpływowym rotacjom.

Tech International Talent Programme Dołącz do Programu Talentów w ING! Kształtuj przyszłość bankowości dzięki innowacyjnej technologii i trzem wpływowym rotacjom.

August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Early Careers: Local Opportunities Related Content -

Wholesale Banking International Talent Programme Dołącz do Programu Talentów w ING! Zostań zaufanym doradcą dla dużych klientów i rozpocznij karierę w trzech rotacjach.

Wholesale Banking International Talent Programme Dołącz do Programu Talentów w ING! Zostań zaufanym doradcą dla dużych klientów i rozpocznij karierę w trzech rotacjach.

August 13, 2024 Article Students & Graduates Early Careers: Global Graduate Programme Related Content -

Różnorodność, integracja i przynależność ING wspiera kulturę różnorodności, integracji i przynależności w sześciu wymiarach - niepełnosprawności, płci, pokoleń, LGBTQI+, rasy i pochodzenia etnicznego oraz kultury - na całym świecie. August 14, 2024 Article Diversity, Inclusion & Belonging

Różnorodność, integracja i przynależność ING wspiera kulturę różnorodności, integracji i przynależności w sześciu wymiarach - niepełnosprawności, płci, pokoleń, LGBTQI+, rasy i pochodzenia etnicznego oraz kultury - na całym świecie. August 14, 2024 Article Diversity, Inclusion & Belonging -

Bezpieczeństwo Chroń naszych ludzi, zasoby i informacje przed zagrożeniami. Stój na straży naszego bezpieczeństwa. August 21, 2024 Article Expertise & Teams Employee Stories Related Content

Bezpieczeństwo Chroń naszych ludzi, zasoby i informacje przed zagrożeniami. Stój na straży naszego bezpieczeństwa. August 21, 2024 Article Expertise & Teams Employee Stories Related Content -

Benefity w ING Banku Śląskim Poznaj ofertę benefitową ING Banku Śląskiego November 19, 2024 Overview Benefits

Benefity w ING Banku Śląskim Poznaj ofertę benefitową ING Banku Śląskiego November 19, 2024 Overview Benefits -

Spółki i fundacje GK ING Bank Śląski Poznaj spółki i fundacje Grupy Kapitałowej ING Banku Śląskiego. November 22, 2024 Article Expertise & Teams

Spółki i fundacje GK ING Bank Śląski Poznaj spółki i fundacje Grupy Kapitałowej ING Banku Śląskiego. November 22, 2024 Article Expertise & Teams -

Biura i lokalizacje ING Bank Śląski Sprawdź gdzie mieszczą się nasze biurowce i jak wyglądają nasze biura. March 03, 2025 Article Overview Early Careers: Local Opportunities Location Spotlight Events Related Content Events Blog

Biura i lokalizacje ING Bank Śląski Sprawdź gdzie mieszczą się nasze biurowce i jak wyglądają nasze biura. March 03, 2025 Article Overview Early Careers: Local Opportunities Location Spotlight Events Related Content Events Blog -

November 25, 2024

November 25, 2024 -

Program ChallengING Program ChallengING w ING Banku Śląskim S.A. oferuje niezwykłą szansę dla osób, które właśnie ukończyły studia lub znajdują się na ich końcowym etapie. November 27, 2024 Overview Students & Graduates Early Careers: Local Opportunities

Program ChallengING Program ChallengING w ING Banku Śląskim S.A. oferuje niezwykłą szansę dla osób, które właśnie ukończyły studia lub znajdują się na ich końcowym etapie. November 27, 2024 Overview Students & Graduates Early Careers: Local Opportunities -

Staż w ING Bank Śląski Poznaj możliwości rozwoju kariery na stażu w ING Banku Śląskim. November 29, 2024 Overview Students & Graduates Early Careers: Local Opportunities

Staż w ING Bank Śląski Poznaj możliwości rozwoju kariery na stażu w ING Banku Śląskim. November 29, 2024 Overview Students & Graduates Early Careers: Local Opportunities -

January 22, 2025 Article Overview Culture Diversity, Inclusion & Belonging Students & Graduates Early Careers: Local Opportunities Events

January 22, 2025 Article Overview Culture Diversity, Inclusion & Belonging Students & Graduates Early Careers: Local Opportunities Events -

January 16, 2025

January 16, 2025 -

Wholesale Banking in Americas Dołącz do Wholesale Banking w ING w Amerykach, gdzie oferujemy innowacyjne rozwiązania finansowe dla klientów korporacyjnych w dużych miastach. August 13, 2024 Article Expertise & Teams Wholesale Banking Related Content

Wholesale Banking in Americas Dołącz do Wholesale Banking w ING w Amerykach, gdzie oferujemy innowacyjne rozwiązania finansowe dla klientów korporacyjnych w dużych miastach. August 13, 2024 Article Expertise & Teams Wholesale Banking Related Content -

Meet Up CIO w ING Banku Śląskim MeetUp Pionu CIO to doskonała okazja dla wszystkich osób zainteresowanych poznaniem tego, jak działa technologiczne serce banku, a więc Pion CIO. March 11, 2025 Article Overview Expertise & Teams Students & Graduates Events Events

Meet Up CIO w ING Banku Śląskim MeetUp Pionu CIO to doskonała okazja dla wszystkich osób zainteresowanych poznaniem tego, jak działa technologiczne serce banku, a więc Pion CIO. March 11, 2025 Article Overview Expertise & Teams Students & Graduates Events Events -

Expert Team Experience Design Projektujemy interfejsy systemów, z których korzystają pracownicy naszego banku. Makietujemy, warsztatujemy i zbieramy feedback od przyszłych użytkowników i użytkowniczek May 08, 2025 Early Careers: Local Opportunities Events

Expert Team Experience Design Projektujemy interfejsy systemów, z których korzystają pracownicy naszego banku. Makietujemy, warsztatujemy i zbieramy feedback od przyszłych użytkowników i użytkowniczek May 08, 2025 Early Careers: Local Opportunities Events -

June 26, 2025

June 26, 2025 -

July 08, 2025

July 08, 2025 -

August 19, 2025 Article

August 19, 2025 Article

Oferty pracy

No jobs viewed

No jobs saved